Sports betting is frequently labelled ‘gambling’ and lumped together with casino games of chance such as roulette, slots, or bingo. While both sports betting and casino games entail risk, reward and the element of chance, conflating the two fails to account for their inherent differences.

While casino games are predominantly driven by chance, contrary to public opinion sports betting is in fact a game of skill. In this article we examine how the two are different and why sports betting is a skill-based discipline.

Let’s start by exploring how casino and bookmaker business models actually work:

How the Casino House Edge Works

Let’s take roulette as an example. The standard roulette wheel is numbered from one to 36. Assuming a fair payout, the odds of winning a bet on any one number would be 36 to one. Of course, there’s no such thing as fair payout in a casino.

European roulette wheels also have a zero pocket, while American roulette wheels typically have two zeros pockets. The zero and double zeros render the true probability of a win to 37 to one and 38 to one respectively. This gives the house an edge of 2.7% on European roulette and 5.25% on its American counterpart.

The house edge represents the average gross profit margin the casino expects to make from that game over its lifespan. For every £1,000,000 wagered, on average the house can expect to rake in £27,000 from European roulette and £52,500 from American roulette.

The house edge will vary across different games, and can be anything from 0.5% in Blackjack (assuming expert play) up to as much as 40% in Keno. The casino edge is the product of the games themselves and it’s not set by individual casinos. There are however variations of the same game and the house edge will vary along with them. Ultimately, the longer you play your casino game of choice, the more likely it is that your results will reflect the house edge.

A player playing a game with negative expected value will eventually go broke, regardless of their betting system.

Statistical notion known as ‘Gambler’s Ruin’

How the Bookmaker Edge Works

What about the bookmaker’s edge? Let’s use a coin toss as an example. The statistical probability of the coin landing on either heads or tails is 50%. The fair odds for both heads and tails would be Evens (2.0 in decimal odds). If you bet £100, you’d double your money as your net winnings would be £100. This makes it a 100% market which represents a fair payout relative to the probabilities of outcome.

((1/2) + (1/2)) * 100 = 100

Fair Payout at Events and 50% Probability

Of course, if bookmakers priced their odds to reflect true probability, their business wouldn’t be commercially viable. Sportsbooks build a margin in their favour by pricing markets to exceed 100%. The deviation of the price offered from the true odds is what gives the bookmakers a mathematical edge.

In the coin toss example, the bookmaker would price heads or tails at odds below Evens (2.0 in decimal odds). If they priced their odds at say 19/20 (1.95 in decimals odds) for both heads and tails, that would translate to a market overround of 102.56%.

((1/1.95) + (1/1.95)) * 100 = 102.56

Bookmaker Margin Formula

In that scenario, you’d need to win 51.28% of your bets to break even. That of course is impossible to achieve in the long run as the true probability of both heads and tails is 50%. Because the bookmaker edge at those odds is 2.56%, they would expect an average gross profit of £25,600 for every £1,000,000 wagered.

Profit margins will vary across different providers and events whereby traditional soft bookmakers may have margins as high as 10% across football markets. The higher the bookmaker margin, the poorer the value of their odds.

How Casinos Differ from Bookmakers

Casino Probabilities Are Fact, Bookmaker Probabilities Are Estimates

Assuming no technical flaws, casino games hold a house edge by design. Therefore, casinos can offer odds with controlled mathematical certainty. In contrast, bookmakers rely on accurately pricing the probabilities of external events.

In the coin toss example, we know that the true probability of either heads or tails is 50%. In real-life sporting events however, the true probabilities of outcome are simply unknown. This is because each and every sports event takes place in real-time is therefore unique. The variables that determine the probabilities of outcome, and their weighting, are also unique to every event. This makes calculating probabilities particularly hard for oddsmakers and bettors alike.

Casinos Are in Full Control, Bookmakers Have Zero Impact

While casinos are in full control of their gaming environments, sports events are completely outside bookmakers’ sphere of influence. Sportsbooks can neither control nor impact the outcome of any particular sporting event that they offer odds for.

Moreover, while bookmakers rely on odds compilers and complex mathematical models, they rarely possess any special insider knowledge about the events that they price. Instead, their analyses are based on data and information that can also be obtained and analysed by the general betting public.

Casino Odds Are Static, Bookmaker Odds Are Variable

Because the casino house edge is a product of game design, the underlying odds don’t require any dynamic adjustment. Bookmakers however often adjust their odds numerous times both before kick-off and over the course of the event.

Sportsbooks will typically offer odds for high-ticket events at least a few days in advance. They’d set the odds based on the relative strength of the teams, the prevailing conditions and the money expected to be wagered for each outcome.

After the initial odds are published, bettors start placing their bets which increases market liquidity. New information about the event may become available, altering the perceived probabilities of outcome and how much money is wagered on the different outcomes. Bookmakers may fine-tune their odds in line with their risk appetite and what they believe true probability to be at that time.

Why Sports Betting is a Game of Skill, Not Chance

In the critically acclaimed book ‘The Success Equation: Untangling Skill and Luck in Business, Sports, and Investing’, author Michael J. Mauboussin explores the degrees to which skill and luck determine success in sports.

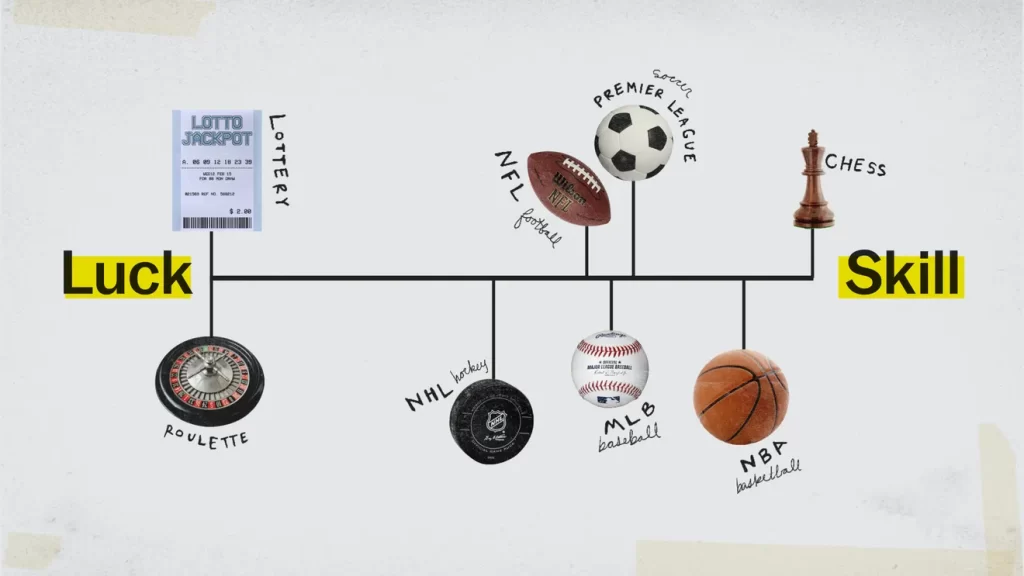

After rigorous data modelling crunching decades of sports stats he produced a continuum which ranks various disciplines from pure luck to pure skill. The Skill-Luck Continuum illustrates how much luck can explain the variance in results in different fields. Mauboussin placed Roulette and Slots at the pure luck end of the spectrum and Chess at the pure skill end.

The book concludes that while sports entail randomness and luck can play a key role, overall success in sports is primarily a product of skill.